Table of Contents

- WFC Stock Price and Chart — NYSE:WFC — TradingView

- WFC - Wells Fargo & Company | Stock Quote, Technical Analysis, Rating ...

- WFC Stock Price and Chart — NYSE:WFC — TradingView

- WFC Stock Price and Chart — NYSE:WFC — TradingView

- Wells Fargo & Co. (WFC) Stock Analysis

- WFC Stock: Wells Fargo Is the Ultimate Dead-Money Play | InvestorPlace

- Wells Fargo Co. (Ticker: WFC) – Weekly Chart – AlienOptions

- 4 Top Stock Trades for Wednesday: AAL, WFC, RIOT, TSLA | InvestorPlace

- WFC Stock Price Slumps 3% On Monday, What Next This Week? - The Coin ...

- Акции WFC — цена и графики (NYSE:WFC) — TradingView

A Brief History of Wells Fargo

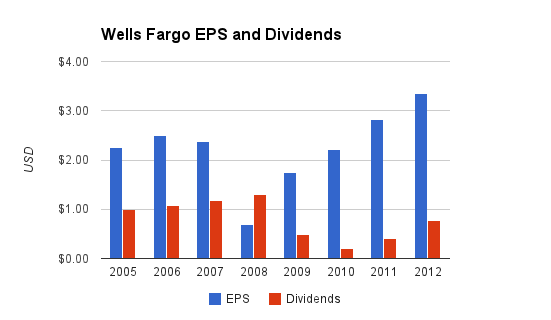

Financial Performance

Investment Potential

Wells Fargo's common stock (WFC) offers an attractive investment opportunity for those looking to diversify their portfolio. With a market capitalization of over $200 billion, WFC is considered a blue-chip stock, offering a relatively stable source of income and long-term growth potential. The company's dividend yield is currently around 3.5%, making it an attractive option for income-seeking investors. Additionally, WFC's price-to-earnings (P/E) ratio is relatively low compared to its peers, indicating that the stock may be undervalued.

Risks and Challenges

While WFC offers an attractive investment opportunity, there are risks and challenges that investors should be aware of. The banking sector is highly regulated, and changes in regulatory requirements can impact WFC's financial performance. Additionally, the company has faced several scandals in recent years, including a fake accounts scandal in 2016, which has impacted its reputation and led to increased regulatory scrutiny. Furthermore, the COVID-19 pandemic has had a significant impact on the global economy, and WFC's financial performance may be affected by the resulting economic downturn. In conclusion, Wells Fargo & Company Common Stock (WFC) is a solid investment opportunity for those looking to diversify their portfolio. With a rich history, strong financial performance, and attractive dividend yield, WFC offers a relatively stable source of income and long-term growth potential. However, investors should be aware of the risks and challenges associated with investing in the banking sector, including regulatory changes and reputational risks. As with any investment, it is essential to conduct thorough research and consult with a financial advisor before making a decision.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Investing in the stock market involves risks, and it is essential to conduct thorough research and consult with a financial advisor before making a decision.