Table of Contents

- What IRMAA bracket estimate are you using for 2024? - Bogleheads.org

- Medicare Irmaa Brackets For 2025 Images References : - Isadora Blake

- Irmaa Brackets 2025 Part B - Ameen Sanaa

- Projected Irmaa Brackets For 2024 - Tonie Corissa

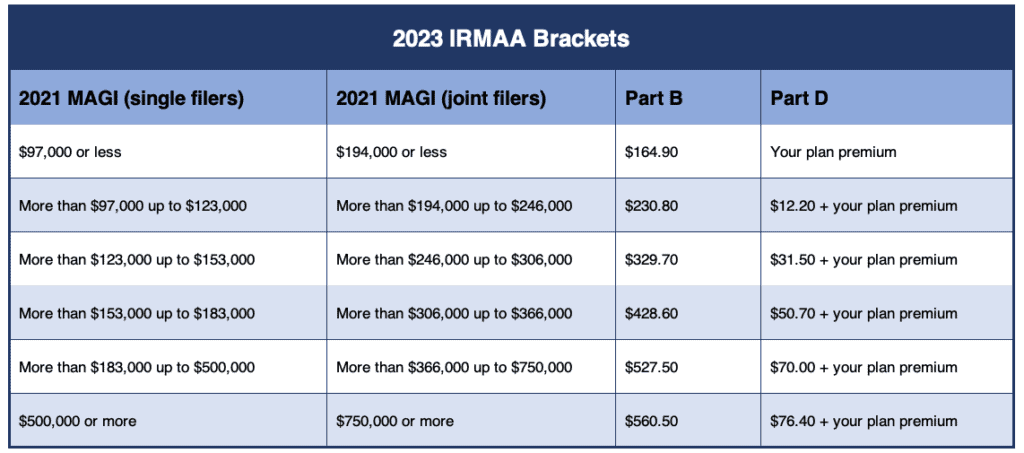

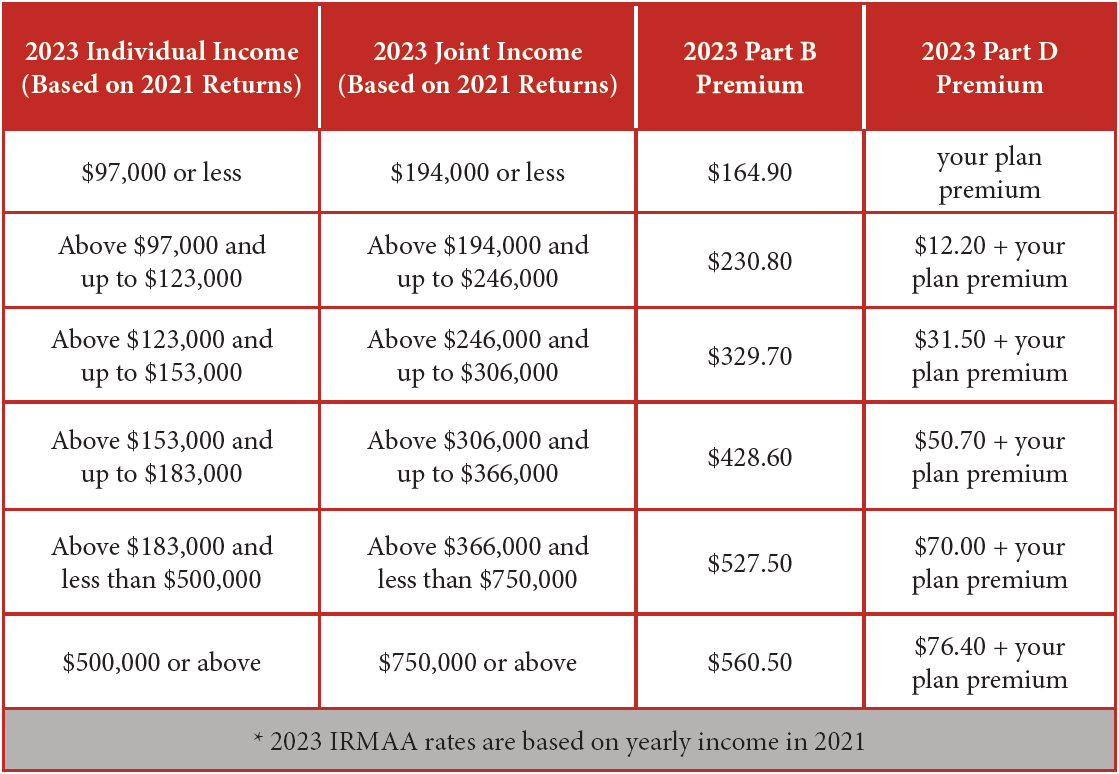

- The 2023 IRMAA Brackets - Social Security Intelligence

- 2025 Medicare Part B Irmaa Premium Brackets 2025 - Morteza Harrison

- Possible 2025 IRMAA Brackets

- Irmaa Brackets 2024 2025 2024 Schedule - Nara Tamera

- 2025 IRMAA Brackets & TSP Contribution Limits Explained.

- 2025 IRMAA Brackets & TSP Contribution Limits Explained.

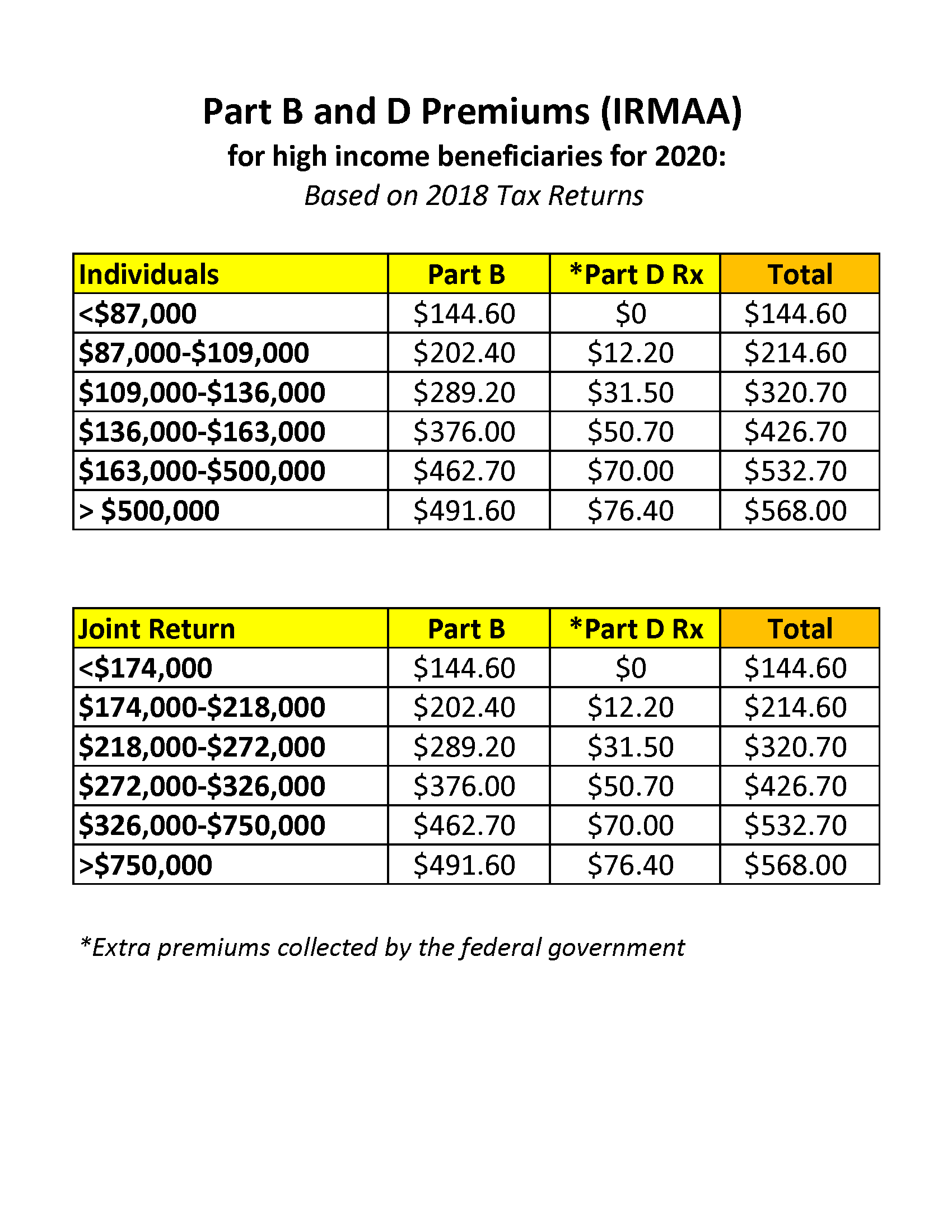

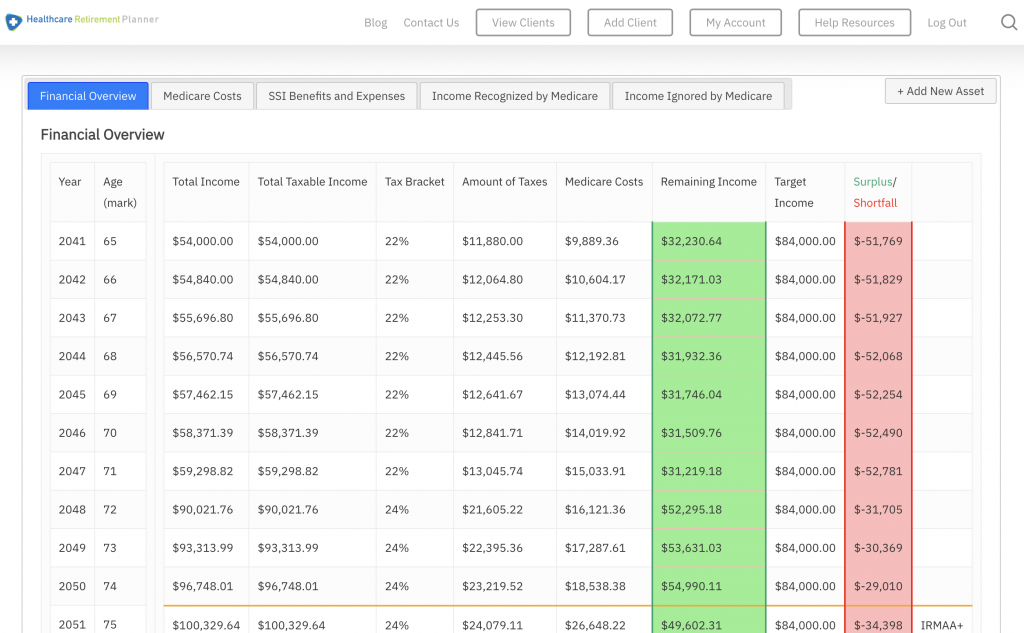

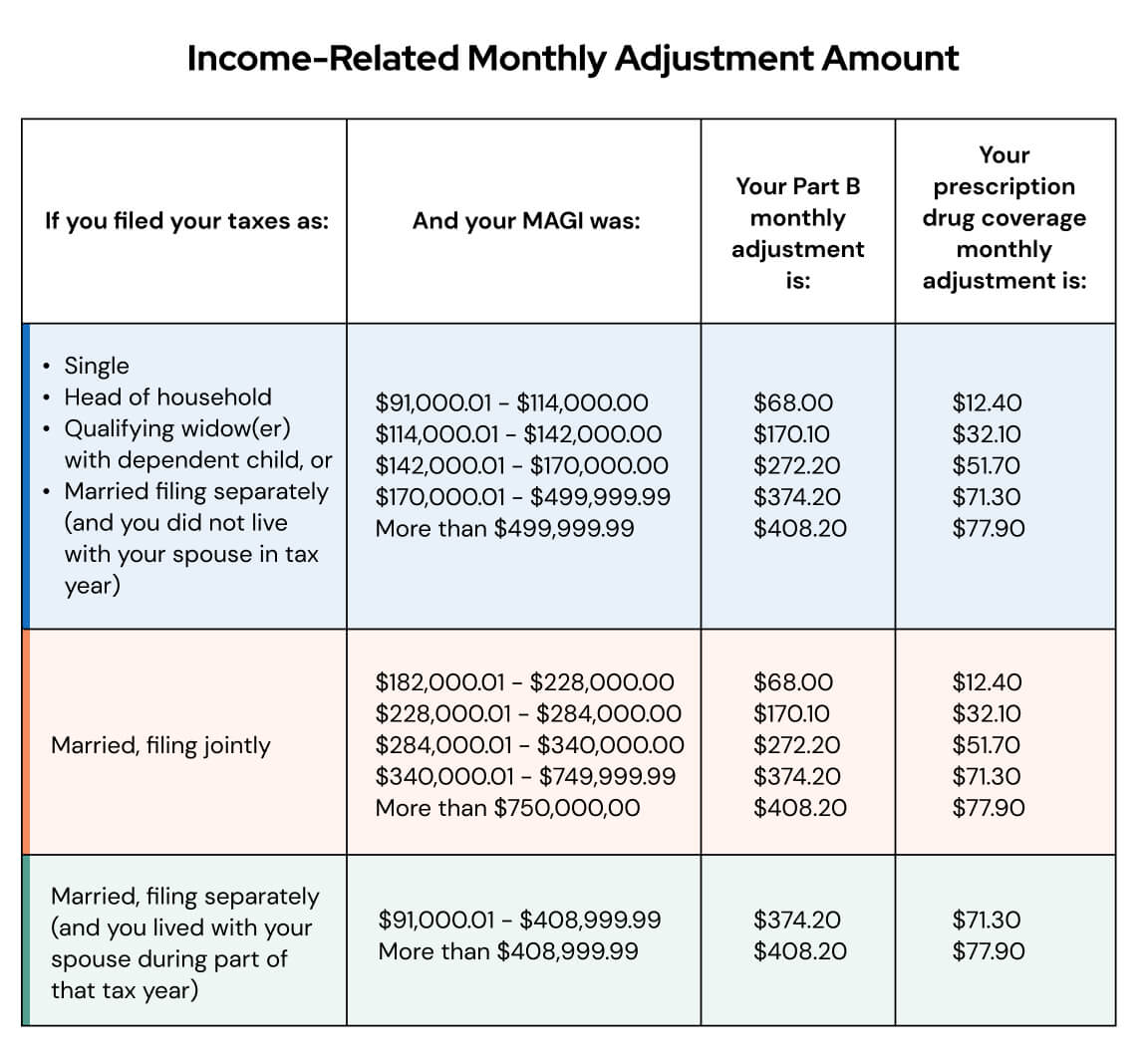

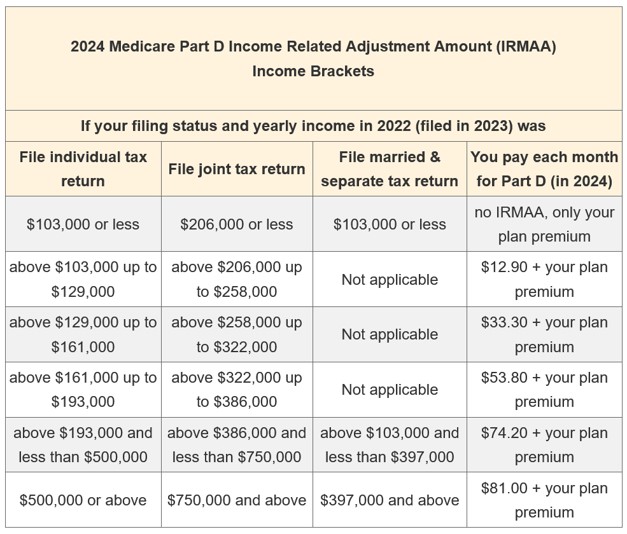

What are IRMAA Brackets?

2025 IRMAA Brackets

How to Minimize Your IRMAA Bracket

While you can't change your income, there are some strategies to minimize your IRMAA bracket: Consider Roth IRA conversions: Converting your traditional IRA to a Roth IRA can reduce your taxable income, potentially lowering your IRMAA bracket. Donate to charity: Donating to charity can reduce your taxable income, which may help you avoid a higher IRMAA bracket. Consult a financial advisor: A financial advisor can help you develop a strategy to minimize your IRMAA bracket and optimize your Medicare premiums. Understanding the 2025 IRMAA brackets is crucial to navigating the complex world of Medicare premiums. By staying informed and exploring strategies to minimize your IRMAA bracket, you can save money on your Medicare premiums and ensure you're getting the most out of your benefits. As a Social Security Pro, we're committed to providing you with the latest information and expert guidance to help you make informed decisions about your Medicare coverage.Disclaimer: The information provided in this article is for general purposes only and should not be considered as professional advice. It's essential to consult with a financial advisor or a Medicare expert to determine the best course of action for your specific situation.